Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

GAS PRICES REACHED A RECORD HIGH

The private sector has recovered all twenty-one million jobs lost in the pandemic’s first two months. However, the substantial gains in employment this year are unlikely to last.

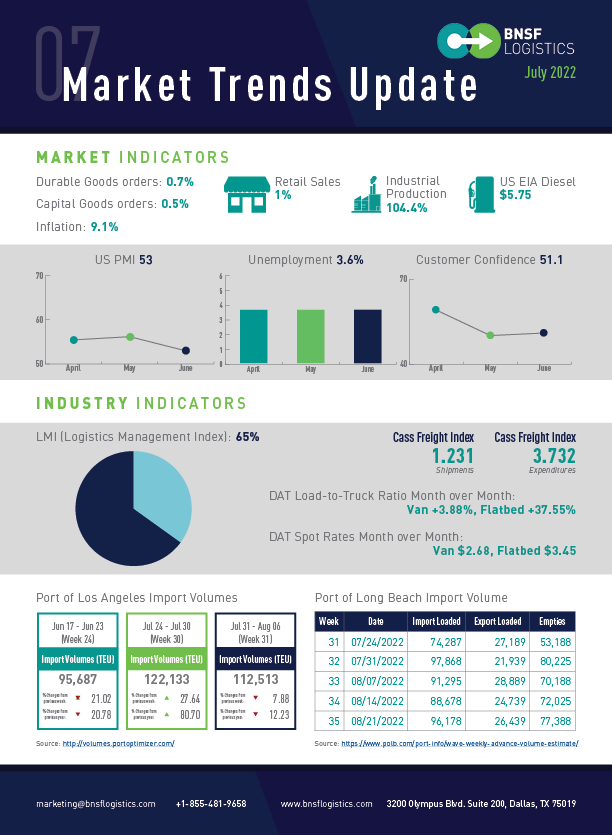

- The unemployment rate was unchanged at 3.6%.

- The U.S. added 372,000 new jobs in June.

- The hospitality business created 67,000 new jobs.

- The labor participation rate is up to 62.3%.

Surging gasoline prices last month drove the rate of U.S. inflation to a nearly 41-year peak; the hike in inflation caused the Fed to increase rates by three-quarters of a percentage point in June and expect to raise another three-quarter of a percentage point at the end of July.

- U.S. inflation is 9.1% (a 41-year record).

- The Federal Reserve Bank increases the rate to 1.75%.

- The average price of a gallon of gas in the U.S. is $5 (highest ever).

Americans are still buying lots of stuff. However, the most significant part of the increase was due to gasoline and food prices, and sales would have fallen if inflation had been considered. For example, Americans bought more new cars in June but paid more to fill up at the gas pump.

- Retail sales rose 1% in June.

- Auto and parts sales rose 0.8%.

The demand for homes in the U.S. is cooling, and builders will remain busy for some time working down backlogs of unfilled orders, even allowing for rising cancellations.

- Single-family homes fell 8.1%, while apartment starts up 15% last month.

- Construction starts down 6.3% in June.

- Permits fell to 0.6%.

The shortage of microchips continues to limit vehicle production, but it’s not the only hurdle. Numerous other supply chain disruptions have limited OEM production.

- Auto sales rose to 13 million from 12.7 million.

- Inventory at the start of June 2022 was down 25%.

- Demand is still outpacing supply.

- Lack of inventory continues to be a factor in sales.

Factories are still pumping out lots of goods despite ongoing supply and labor shortages, but talk of recession is making them reconsider their future plans.

- Orders at U.S. factories for durable goods rose 0.7% in May.

- Business leaders are concerned; only 19% are optimistic about the following year’s economy.

- Commercial airplane new orders down 1.1%.

- Orders for new cars and trucks rose 0.5% in May.

THE OVERALL ECONOMY KEEPS EXPANDING FOR THE 25TH MONTH IN A ROW

After a contraction in April and May 2020, the economy kept its upward trend for the last two years.

- June Manufacturing PMI® registered 53%.

- Down 3.1% from the previous month.

- Demand dropped.

- Customers’ inventories remain at an exceptionally low level.

- Backlog of Orders Index decreasing.

All of the six biggest manufacturing industries — Computer & Electronic Products; Machinery; Transportation Equipment; Petroleum & Coal Products; Food, Beverage & Tobacco Products; and Chemical Products — registered moderate-to-strong growth in June.

The logistics industry continues its regression after nearly two years of rapid growth.

- The LMI June reading was 65.0 which is down 2.1 points from May.

- Transportation Price is down 61.3.

- Transportation Capacity is 61.7.

Transportation Prices have always been a bell-weather for economic activity. The shock of COVID-19 kicked off the runaway transportation markets of the last few years, and now it looks as though the shock of Russia’s invasion of Ukraine has ended it.

The shipments component of the Cass Freight Index® shipments fell 4.1% m/m in June, reversing the 4.0% increase in May.

- The shipments component has been down 4 of 6 months this year on a y/y basis.

- Inventory has shifted from a significant tailwind for freight demand to more of a neutral.’

The expenditures component of the Cass Freight Index rose 8.8% m/m in June to a new record, with shipments down 2.6% and rates up 11.7%.

Orders for Trucks continue to be subdued as 2023 build slots remain restricted due to limited visibility into future conditions surrounding material costs and lead times.

- Class 8 net orders for June rose to 15,000 units m/m, up 13% from May.

- Trailer orders fell back in June to 14,400 units. Down 23% m/m.

The order numbers are consistent with traditional trends entering the summer months. However, usually, the numbers drop because fleets have ordered all the trailers they need for the year.