Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

RETAIL SALES RISE BUT INFLATION AND SUPPLY CHAIN CONCERNS PERSIST

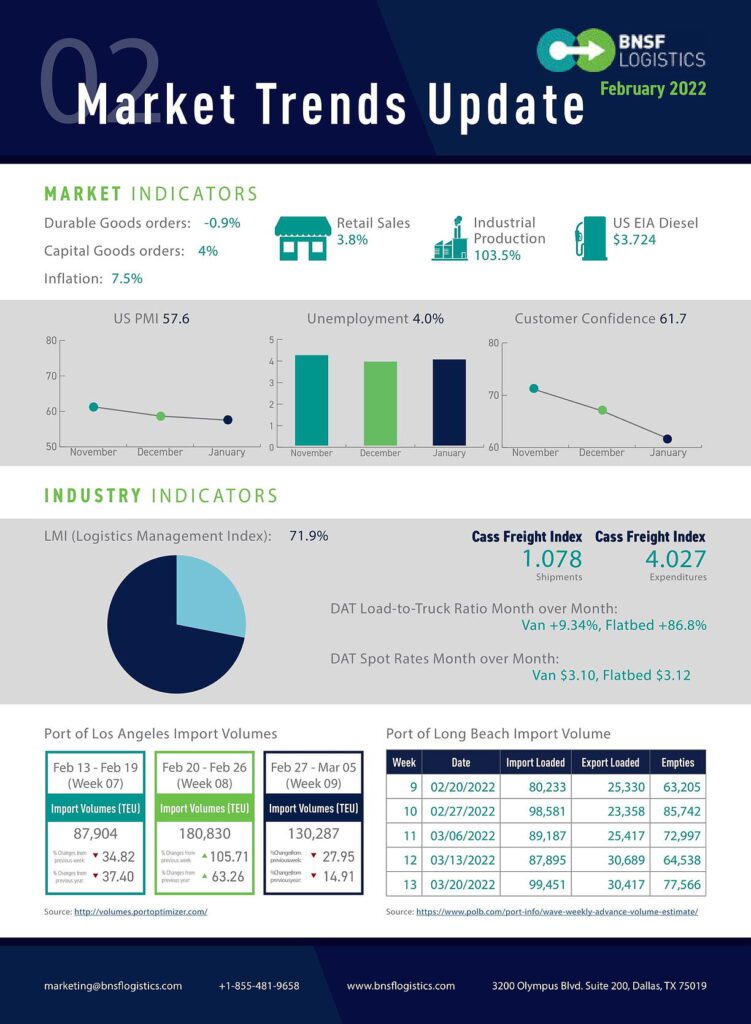

U.S. unemployment in January increased slightly to 4.0%, up 0.1% from last month despite the economy adding 467,000 jobs in January. We are still 3.5 million positions below the pre-pandemic level of employment in February of 2020. The number of open positions at the end of November was about 10.5 million. The labor participation rate continues to improve, sitting at about 62.2%, however, this is still below the rate of 63.1% in February 2020.

Retail sales rose 3.8% sequentially in January, and up 12.7% from January 2021. The sequential growth was driven by an increase in non-store sales (up 14.5%), department store sales (up 9.2%), and furniture sales (up 7.2%). The core inflation, which excludes food and fuel prices, rose 6.0%, while the annualized overall inflation rate was 7.5%, which is the highest level in almost 40 years. Many items are more expensive than they were a year ago, including energy (up 27% overall), gasoline (up 40%), and the cost of electricity (up 11%). Consumer sentiment, which tends to be a leading indicator, dropped 10.3% in early February 2022, making it the lowest level in more than a decade.

The United States has a shortage of somewhere between 1 million and more than 5 million homes. Housing starts and completions both dropped in January, which is not a great start to the year. However, permits for new construction rose to the highest level since January of last year. Part of the slow start is due to the winter weather in January, but labor shortages compounded by absenteeism due to the omicron surge are also a cause. At the National Association of Home Builders’ annual convention, it was noted that mortgage rates could further slow sales as homes become less affordable, and therefore, is only expecting annualized growth of 1% in 2022.

New automobile sales in January dropped 8.3% from January 2021. This decrease in sales is mainly caused by the shortage of semiconductor chips. January’s month-end retail inventory is expected to be below 1 million units for the eighth consecutive month and the volume of new vehicles arriving at dealerships is insufficient. Manufacturers are shutting down plants due to the shortage and the expectation is that the chip shortage will continue to plague production through the balance of 2022. Demand for semiconductor chips has increased by about 17% since 2019 and new production is not coming online fast enough to make up for the increasing and compounding manufacturing impacts caused by the COVID lockdowns over the last year.

THE LOGISTICS INDUSTRY’S CONTINUED EXPANSION

The Purchasing Manager’s Index (PMI) for January was 57.6%, a 1.2-point decrease from December. This indicates expansion in the PMI for the 20th consecutive month after the contraction in April of 2020 (anything greater than 50 equals growth). Durable goods orders increased 2.5% in November to $268.3 billion, while shipments (0.7%) and unfilled orders (0.7%), inventories (0.6%), and capital goods (4.0%) all increased slightly.

The Logistics Management Index (LMI) for December was 70.1, a 3.3-point decrease from November. The LMI index has been above 70 for eleven consecutive months, as well as 14 of the past 16 months. There is some concern now that supply chains may now be carrying too much inventory – potentially a result of firms choosing the “lesser of two evils” and stocking up to avoid potential missed holiday sales. This could foreshadow a coming bullwhip effect in which supply chains over-ordered to avoid shortages and are now dealing with the burden of having too much inventory – or too much of the wrong type of inventory. Transportation capacity was 42.6% in December, up 2.9% from November, while transportation utilization is down 5.5 points to 67.1%. Additionally, transportation prices dropped to 87.6% in December, down 5.6 points from November. Transportation prices, although remaining elevated, are down to levels not seen since the 2021 summer, breaking the streak of 5 consecutive months over 90. Looking at the other factors that make up LMI, warehousing and inventories, December showed an increase of 2.5 points to 46.5% for warehouse capacity, an 8.2-point decrease to 82.1 in warehousing prices, and a decrease of 3.6 points to 84.0 for inventory costs, while the inventory level is up 2.8 points to 61.6%.

COVID-19 UPDATE – OMICRON VARIANT BEGINS TO SLOW

The omicron variant surged higher and faster than other variants, rising from an average of 80K daily cases in early December to an overage of over 800K daily cases by mid-January, and now dropping to an average of 80K daily cases at the end of February. However, with the availability of at-home test kits, there are likely significantly more cases that simply were not reported.

Vaccination rates have slowed again and are likely to not move much with omicron variant cases starting to slow down greatly. 65% of the US population is now fully vaccinated with another 12% having received at least the first dosage of the vaccine.