Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

RETAIL SALES TAKE A SHARP DROP

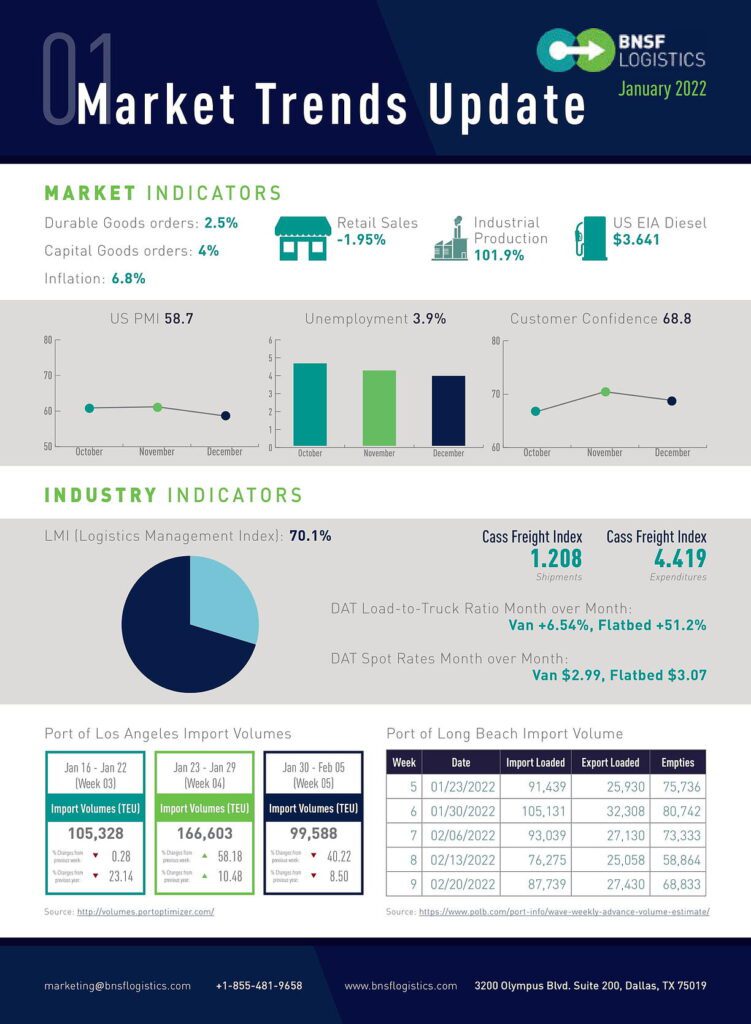

U.S. unemployment in December dropped to 3.9%, down 0.3% from last month, and follows the trend of gradual but slow improvement. 199,000 jobs were created in December, which is the lowest level of monthly growth that we have seen all year. We are still 3.5 million positions below the pre-pandemic level of employment in February of 2020. The number of open positions at the end of November was about 10.5 million. The labor participation rate increased slightly, sitting at about 61.9%, but despite this step in the right direction, we still need more people to re-enter the labor force. We are seeing higher levels of growth in the surveys which would indicate more individuals are re-entering the labor force, but instead of working for a company, they are going out on their own. This was a trend we saw this past year in the trucking sector, especially with so many new entrants that were owner-operators.

Retail sales fell 1.9% in December to $626.8 billion due to sharp declines in online shopping and dining. Despite another increase in prices, this shows the actual units of sales are declining more quickly. Excluding auto sales, the decline was sharper at 2.3%, ending the year on a bit of a sour note but for the year retail sales were up 16.9% from the pandemic impacted 2020 results. The core inflation, which excludes food and fuel prices, was up 5.5%, while the annualized overall inflation rate was 7.0%, which is the highest level in almost 40 years. Consumer sentiment, which tends to be a leading indicator, dropped 2.5% to 68.8 in early January 2022, which is 12.9% below its value in January 2021 and now stands at the second-lowest level in almost a decade smart factory industry 4.0

New home starts increased to a nine-month high in December, increasing by 1.4% to a seasonally adjusted rate of 1.702 million units. Building permits for future homes rose by 9.1% to a seasonally adjusted rate of 1.873 million in December. Single-family building permits rose 2.0% while permits for building with 5+ units increased 19.9%. While the housing starts and permits have increased, this may be hampered by the soaring prices for materials after the government nearly doubled duties on imported Canadian softwood lumber.

Automobile sales in December 2021 totaled just 12.44 million units, down 23.7% from December 2020. Annual light-vehicle sales totaled 14.93 million units in 2021, which is up 3.1% from 2020. Tight inventory levels combined with high consumer demand pushed average transaction prices to new highs throughout 2021. The average transaction price increased to over $45K in December but was driven also by the prioritization of higher-priced and more in-demand vehicles as well as lower dealer incentives. Monthly sales will likely continue to be dictated by the number of vehicles available rather than by demand in 2022 due to supply constraints hindering production. This is likely to continue as the already strained supply chains and backlogged chipmakers experience further stress from emerging Covid-19 cases.

THE LOGISTICS INDUSTRY’S CONTINUED EXPANSION

The Purchasing Manager’s Index (PMI) for December was 58.7%, a 2.4-point decrease from November. This still indicates expansion in the PMI for the 19th consecutive month after the contraction in April of 2020 (anything greater than 50 equals growth). Durable goods orders increased 2.5% in November to $268.3 billion, while shipments (0.7%) and unfilled orders (0.7%), inventories (0.6%), and capital goods (4.0%) all increased slightly.

The Logistics Management Index (LMI) for December was 70.1, a 3.3-point decrease from November. The LMI index has been above 70 for eleven consecutive months, as well as 14 of the past 16 months. This may suggest that some supply chains may now be carrying too much inventory – potentially a result of firms choosing the “lesser of two evils” and stocking up to avoid potential missed holiday sales. This could foreshadow a coming bullwhip effect in which supply chains over-ordered to avoid shortages and are now dealing with the burden of having too much inventory – or too much of the wrong type of inventory – on hand. Transportation capacity was 42.6% in December, up 2.9% from November, while transportation utilization is down 5.5 points to 67.1%. Additionally, transportation prices dropped to 87.6% in December, down 5.6 points from November. Transportation prices, although remaining elevated, are down to levels not seen since the 2021 summer, breaking the streak of 5 consecutive months over 90. Looking at the other factors that make up LMI, warehousing and inventories, December showed an increase of 2.5 points to 46.5% for warehouse capacity, an 8.2-point decrease to 82.1 in warehousing prices, and a decrease of 3.6 points to 84.0 for inventory costs, while the inventory level is up 2.8 points to 61.6%.

COVID-19 UPDATE – OMICRON VARIANT CONTINUES TO SPREAD

Due to the Omicron variant, Covid-19 cases have risen significantly in the past month, with a 7-day average that is 6 times higher than our last update. This variant has proven to be much more contagious and transmissible, and we have seen some local responses in terms of restrictions and lockdowns. Another 9 million Americans received their initial vaccinations last month, and 7 million received their second dose, with now 63.6%% of Americans being fully vaccinated. As we have seen though, the vaccination is not a remedy since many of those being infected with the latest variant include those that were vaccinated previously.